Alinda Agrees to Sell Benelux Inland Ports Owner BCTN

Comments Off on Alinda Agrees to Sell Benelux Inland Ports Owner BCTNInvestment funds managed by Alinda Capital Partners have agreed to sell their 100% interest in BCTN to Infracapital, the infrastructure equity investment arm of M&G Plc.

BCTN is the largest inland container terminal business in the Netherlands and Belgium, owning and operating a network of eight inland container terminals.

Herman Deetman, Managing Director at Infracapital, said, “We are delighted to acquire BCTN and help drive its future as a leading provider of sustainable and essential infrastructure solutions.”

Chris Beale, Chairman of Alinda Capital Partners, said, “BCTN has been a leader as a sustainable inland ports business, and we have been pleased to support its expansion from the Netherlands into Belgium and its opening of new terminals. We expect BCTN to flourish under its new owner.”

Alinda and USS Agree to Acquire Peco Pallet, Inc.

Comments Off on Alinda and USS Agree to Acquire Peco Pallet, Inc.Investment funds managed by Alinda Capital Partners and Universities Superannuation Scheme have agreed to acquire PECO Pallet, Inc., one of North America’s largest providers of pooled rental pallets to the food service, grocery and consumer products industries.

PECO currently operates a North American pallet pool network encompassing more than 80 facilities and 21 million pallets. The company builds, services, delivers, and manages distribution of its red, high-quality block pallets for America’s top consumer products, grocery, and other food-related enterprises to ship their goods. PECO operates in all 50 states of the United States, and in Canada.

PECO is headquartered in Irvington, New York.

Alinda Fund III has Strong Gain On First Exit

Comments Off on Alinda Fund III has Strong Gain On First ExitAlinda Capital Partners, an independent fund manager focused on mid-market core-plus infrastructure investments in North America and Europe, has sold Alinda Infrastructure Fund III’s interest in Energy Assets Group Limited in the United Kingdom to a consortium comprising European institutional investors and an infrastructure fund.

This is the first exit for Fund III.

As part of the sale, an Alinda-managed co-investment vehicle also exited the company, as did a minority shareholder which was a vehicle of Hermes Infrastructure, so that the buyers acquired 100% of Energy Assets.

Headquartered in Livingston, Scotland, Energy Assets is the largest independent provider of industrial and commercial gas metering services in the United Kingdom by number of meters owned and managed, and is a provider of multi-utility network metering and data services.

Alinda led the take-private acquisition of Energy Assets for £286 million in July 2016 and led the sale for £612 million in April 2020.

Alinda Chairman Chris Beale and Managing Partners Andrew Bishop and Jim Metcalfe each made statements.

“We were attracted to Energy Assets’s strong team and its contracted cash flows that provide a floor on the downside,” said Metcalfe. “We made a good sector call. We were a relatively early entrant into the metering sector and, after we made the investment, transaction multiples increased in the sector. New entrants have been willing to pay a premium for platforms with contracted cash flows and demonstrated growth.”

Added Bishop, “Our investment thesis was borne out. The Energy Asset’s team acquired additional portfolios of contracted meters, boosting EBITDA substantially. The increase in EBITDA combined with the increase in transaction multiples enabled us to deliver superior returns for our investors. It is a testament to Energy Assets and its team that the company has proven to be very resilient in these uncertain times.”

Beale said, “Regulatory risk is a rising concern for infrastructure investors. Investing in meters under long term contracts with utilities, rather than in the utilities themselves, was a smart way to gain exposure to utilities without taking regulatory risk on our equity return. Energy Assets exemplifies how we approach investing in utility-related infrastructure.”

Alinda was advised by Evercore and Linklaters.

Alinda Acquires U.K. Digital Infrastructure Company Glide

Comments Off on Alinda Acquires U.K. Digital Infrastructure Company GlideInvestment funds managed by Alinda Capital Partners today acquired Glide Group, the UK’s leading provider of broadband for student accommodation and for regional small and medium enterprises. The business is headquartered in Clevedon and has offices in Birmingham and Coventry in the United Kingdom.

Glide is a B2B digital infrastructure business serving student accommodation, build-to-rent residential accommodation, and regional business parks. Glide benefits from having long term contracts with universities. Glide has built the UK’s leading national fiber network in this specialist market, reaching approximately 100,000 premises and approximately 250,000 customers.

Jim Metcalfe, Managing Partner of Alinda, said, “Digital infrastructure is a priority area of focus for us. Glide has an outstanding management team and we look forward to supporting them in the continued growth of the business.”

Addleshaw Goddard acted as legal counsel to Alinda in the transaction.

—–

See Sky News story: Heathrow investor in Glide towards £200 million student broadband firm

![]()

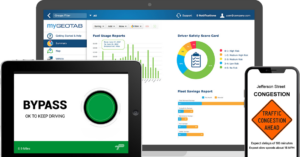

PrePass App is Now on Geotab

Comments Off on PrePass App is Now on GeotabPHOENIX, AZ – The PrePass® app, the leading provider of weigh station bypass services in the United States, is now integrated with Geotab, a leading telematics provider to truck fleets. This integration allows motor carriers to access PrePass weigh station bypass notifications and driver safety alerts directly within the Geotab Drive app.

Geotab’s telematics solution, which is utilized by more than 2 million vehicles, enables trucing companies to make data-driven decisions to help them better manage their fleets. Processing more than 40 billion data points each day, Geotab provides customers with the tools needed to monitor and optimize vehicle efficiencies, including fuel consumption, engine data, driver productivity and safety and hours-of-service.

“The integration of PrePass for Geotab customers provides seamless access to bypass and safety alerts through the Geotab Drive application,” said Mark Doughty, President and CEO of PrePass Safety Alliance. “We are excited to offer this integration and help more carriers save time and fuel, while improving highway safety.”

Investment funds managed by Alinda Capital Partners own CVO | Connected Vehicle Optimization which administers the PrePass programs.

Alinda Forms $500 Million Strategic Alliance with QTS, a Leader in Data Centers

Comments Off on Alinda Forms $500 Million Strategic Alliance with QTS, a Leader in Data CentersAlinda Capital Partners has formed a strategic alliance with QTS Realty Trust (“QTS”), one of the largest publicly listed owners and operators of data centers. Under this strategic alliance, Alinda has a right of first offer on all private capital raised for hyperscale data centers for the next five years.

Investments funds managed by Alinda will make the first investment under the strategic alliance in acquiring a 50% interest in a 65,206 square foot hyper-scale data center in Manassas, Virginia. The Manassas data center is currently leased to a leading global cloud-based software company under a long-term lease agreement.

Virginia International Gateway Installs the Largest Cranes in America

Comments Off on Virginia International Gateway Installs the Largest Cranes in AmericaNueva Era Pipeline Helps Usher in New Era Of Gas Exports To Mexico

Comments Off on Nueva Era Pipeline Helps Usher in New Era Of Gas Exports To MexicoIn RBN Energy’s blog A Better Tomorrow – Nueva Era Pipeline Helps Usher in New Era of Gas Exports to Mexico, Housley Carr discusses gas flows across the U.S.-Mexico border and zeroes in on recent flows through the Nueva Era Pipeline, a 630-MMcf/d pipe from the Eagle Ford to the industrial center of Monterrey.

Alinda Acquires 49% interest in Maurepas Pipeline

Comments Off on Alinda Acquires 49% interest in Maurepas PipelineInvestment funds managed by Alinda Capital Partners have agreed to acquire a 49 percent interest in Maurepas Pipeline Pipeline, LLC for $350 million from SemGroup Corporation (NYSE:SEMG). The transaction will be structured as the sale of Class B interests. The transaction is expected to close by year-end 2018, and is subject to certain closing conditions.

Under the terms of the agreement, SemGroup has an option to reacquire the interest prior to the fifth anniversary of closing, subject to a 24-month non-call period. The call price is based on a predetermined fixed return on Alinda’s investment, including capital contributions.

“We are pleased with the opportunity to partner with Alinda on this high-value transaction and make a significant stride forward in achieving our leverage goals,” said SemGroup President and CEO Carlin Conner. “The valuation multiple provides SemGroup with an attractive cost of capital and the financial flexibility to pay down debt and de-lever our balance sheet while also reinvesting those funds in high-return areas surrounding our footprint. The favorable terms of the transaction provide the option to buy back Alinda’s interest in Maurepas, which is an extremely stable asset supported by long-term contracts with Gulf Coast refineries.”

Chris Beale, Alinda’s Managing Partner, added, “We are excited to partner with SemGroup on this strategically important pipeline system with stable long-term contracts. Maurepas is an excellent fit with our midstream infrastructure investment strategy.”

SemGroup will remain the majority owner and operator of the pipeline system, which consists of three separate transportation pipelines serving refineries in the Gulf Coast region of Louisiana.

____

This transaction was completed on October 22, 2018.

Owner of Prepass and Alinda Announce New Strategic Partnership

Comments Off on Owner of Prepass and Alinda Announce New Strategic PartnershipHELP Inc. (now known as the PrePass Safety Alliance – see footnote), the owner and provider of PrePass® weigh station bypassing and other advanced truck safety and toll payment technologies, and Alinda Capital Partners, one of the world’s largest and most experienced infrastructure investment firms, have announced a new strategic partnership to further advance HELP’s mission of highway safety and efficiency.

HELP, a non-profit 501(c)(3) public charity, is governed by a Board of Directors comprised of an equal number of State government agency and trucking industry representatives, ensuring that solutions and services that support and enhance public safety are balanced between safety and freight efficiency. Upon receiving HELP Board approval in late May, Alinda completed the acquisition of HELP’s contractor, CVO Holding Company, LLC, which will continue to provide contractual services to HELP.

Founded in 1993, HELP was the first non-profit public-private partnership dedicated to advancing the safety and efficiency of the commercial transportation industry. As of July 30, 2018, PrePass has provided over 818 million safe truck bypasses of open weigh facilities throughout the U.S., saving the motor carrier industry over $6.1 billion in operating costs. In the same timeframe, PrePass reduced truck-related pollution by 722,718 metric tons, the equivalent of taking 128,903 automobiles off the road.

Alinda, formed in 2005, has made significant investments in leading transportation assets such as Heathrow Airport in the United Kingdom and the Virginia International Gateway (VIG) container terminal in Norfolk, Virginia. Heathrow recently won U.K. parliamentary approval to build a third runway to approximately double Heathrow’s capacity, and VIG is embarked on an expansion in partnership with the Virginia Port Authority that will nearly double the terminal’s capacity.

“We are thrilled to enter into this strategic partnership with HELP,” said Alinda’s Managing Partner, Chris Beale. “We want to support HELP in its important safety mission and to assist HELP to expand its technology and safety offerings to government agencies and the trucking industry,” Beale said. “Alinda and HELP also strongly support the emissions benefits of bypassing safe, compliant trucks.”

“The HELP Board viewed Alinda’s partnership proposal as an intriguing next step to providing even greater innovation and continuous improvements to customer service in achieving our mission of highway safety,” said Karen Rasmussen, HELP’s Chief Executive Officer. “We are excited about the evident synergies of the HELP-Alinda strategic partnership and look forward to a close working relationship that will benefit all our stakeholders – government, the trucking industry and the motoring public alike,” Rasmussen said.

—-

HELP Inc. changed its name to the PrePass Safety Alliance on May 19, 2019.